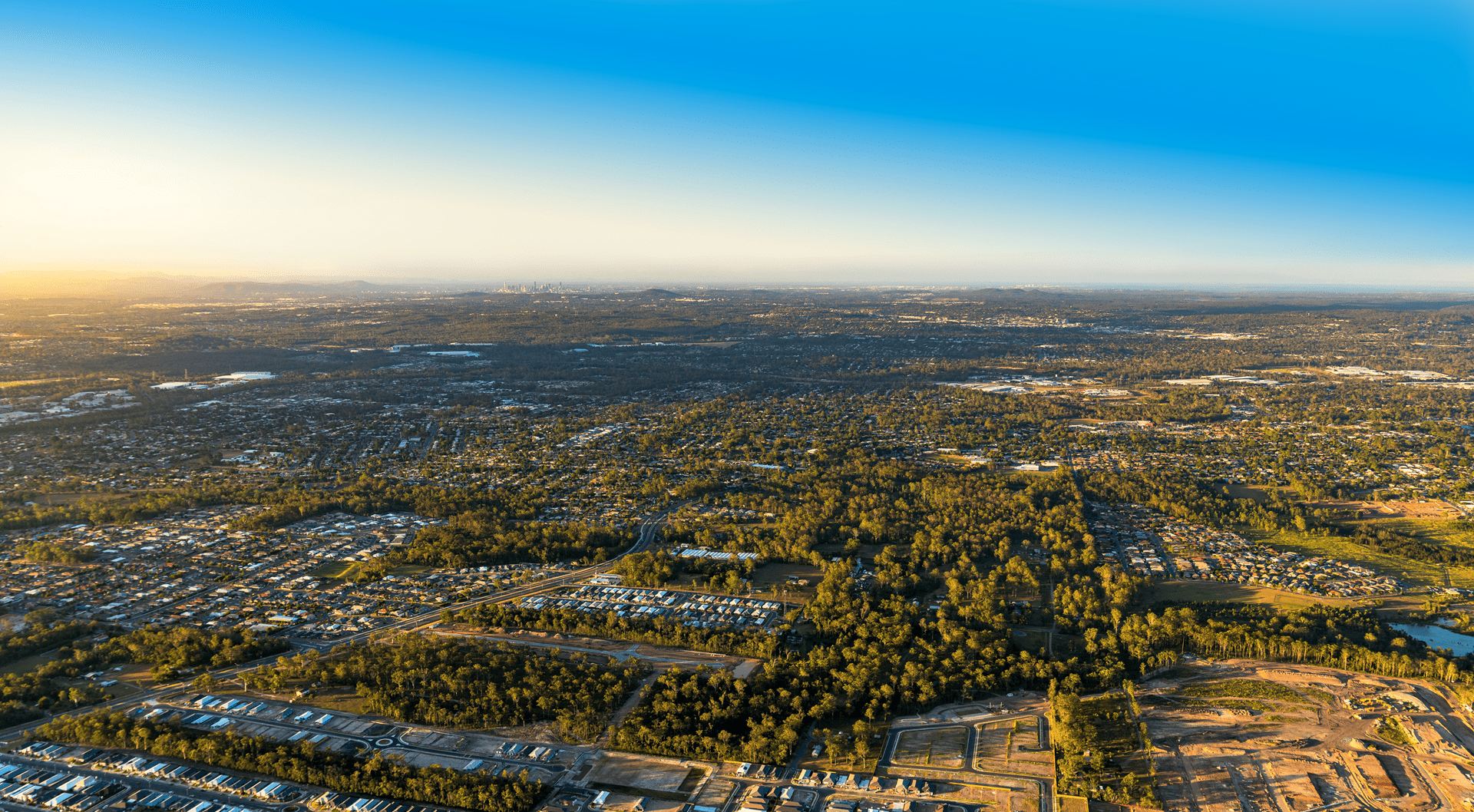

What is there to not like about South East Queensland? If you’re a fan of the snow, then maybe it’s not for you.

But for the vast majority of Aussies, South East Queensland presents an attractive opportunity for those wanting both affordability and lifestyle, two key attributes SEQ offers in spades. The region, which includes Brisbane, Sunshine Coast, and the Gold Coast, is an attractive proposition for both interstate migrants and property investors, of course as well as locals who already call SEQ home.

SEQ is so attractive, ANZ, one of the ‘Big Four Banks’, spent $4.9 billion last year buying Suncorp so they could expand their presence in Queensland and help shape what they believe is a “thriving community.”

“Queensland has a great opportunity to accelerate its very strong economic growth,” ANZ Chief Executive Shayne Elliott said in a recently published 92-page report Queensland: Future State.

The report was produced by Queensland-based economic consulting firm, Adept Economics, with the brief to provide an overview of the state, to assess its direction, and outline a scenario where Queensland’s outperformance is amplified.

The top line? Confidence is high. Very high, and it’s hard to disagree when you look at Queensland’s future opportunities.

When evaluating the advantages of getting Suncorp Group's banking activities, we observed a region that was gifted with desirable population trends, plentiful natural resources, premier tourism, and – particularly significant for ANZ which is Australia's most international bank – great access to the area, according to Elliott.

What are the forecasts for the economy?

Adept Economics believes Queensland’s economy will grow 31 per cent by the next decade, but it has the potential of expanding 46 per cent in the same timeframe.

Adept has estimated that targeting specific growth industries and investing $1.3 trillion over the next 10 years leading up to the 2032 Olympics would be necessary. Elliott believes the Olympics are a one-of-a-kind opportunity to take advantage of the attention and enthusiasm it will generate. He also believes that the potential for growth is large and that the present state of Queensland, as outlined in the Queensland: Future State document, can be further developed beyond the typical expectations.

What will drive the economy?

In one word, migration.

There were a number of reasons why Queensland presented itself as a sought-after destination when the pandemic hit.

It shone a light on the lifestyle opportunities which were very clear already to those who lived in South East Queensland, but maybe not to southern capital city dwellers. When remote working became the norm, those wanting to avoid both the cold and lockdowns, particularly in Sydney and Melbourne, there was an influx of interstage migration.

The November 2022 ANZ Corelogic Housing Affordability Report suggested the relative affordability of housing across Brisbane and the rest of Queensland compared to NSW in particular, is one potential ‘pull’ factor that drove higher migration to the state through to early 2022, lifting property prices.

There was a net gain of over 55,000 people in the 12 months to June 30 2022, numbers not seen since the 1990s. The Australian Government Centre of Population website has a real time population estimate for Queensland, and at the time of posting this article, it forecasted the population at the end of the 2032-33 financial year to be 6.16 million. Currently it’s around 5.43 billion.

How does migration impact housing?

In Gallery Group’s first G-News Property Market Masterclass, economist Dr Andrew Wilson highlighted that now people need somewhere to live.

“As we've seen through the lock up period, migration has been a change to demand factors,” Dr Wilson said.

“Firstly of course, with closed borders, we stopped international migration. We have resumed that now and of course that’s providing a significant drive into our housing market, particularly the rental market, through permanent migrants and of course those temporary visa migrants and students putting a lot of stress on our rental markets.

“We also had some changes through lockdown in interstate migration patterns, particularly out of the southern states where we saw a surge as a consequence of those severe lockdowns into South East Queensland, and that of course produced a boom in prices and rents generally.”

Dr Wilson says now that demand needs to be matched with home building.

“That’s the big issue in terms of housing market balance at the moment, we’re just not building enough housing,” Dr Wilson said.

“We’re way short of being able to provide housing for our population, much less at the surge in migration that we’re currently experiencing. That’s why we are seeing particularly higher rents and are likely to see continual upward pressure on home prices.”

So what about housing?

Adept Economics’ Queensland: Future State report said there is an “urgent need” to address housing availability. They said it’s arguably even more important in Queensland than anywhere else in the country given Queensland is expected to see faster population growth than the national average.

“If suitable accommodation is not provided, Queensland investment projects may not be able to secure a sufficient supply of local workers or would become more reliant on fly in, fly out (FIFO) workers,” the report noted, suggesting that if this were the case, then Queensland may not capture as great a share of the benefits as it otherwise would, particularly if workers are flown in from interstate.”

Brisbane has bucked the trend of the rest of the country when it comes to building approvals. Total dwelling approvals are over -18 per cent down since this time last year, the latest data from the ABS showed, however Brisbane approvals were up nearly 10 per cent over the last 12 months.

The issue however clearly isn’t in approvals. Developers are struggling to make their projects stack up due to the significantly higher build costs, a combination of higher cost of materials and a higher cost of labour due to the lack of readily available builders in the state. If developers can’t secure at the very least a 10 per cent margin, don’t expect projects to be started.

Even with the Olympics under a decade away, Adept believes achieving adequate housing supply will be one of the state’s most significant challenges over the next 10 years.

They do note that the Olympics can motivate and stimulate new investment in civic infrastructure, such as transport, and in additional housing and accommodation. That was evident in Los Angeles following the 1984 Summer Olympics, and the Atlanta 1996 Summer Olympics, where their athletes' villages became student accommodation for local universities. Brisbane’s athletes village has been muted to become residential housing, which will help the chronic undersupply of housing the city is facing.

Growth is forecast to come to all areas of Brisbane and the wider South East Queensland region.

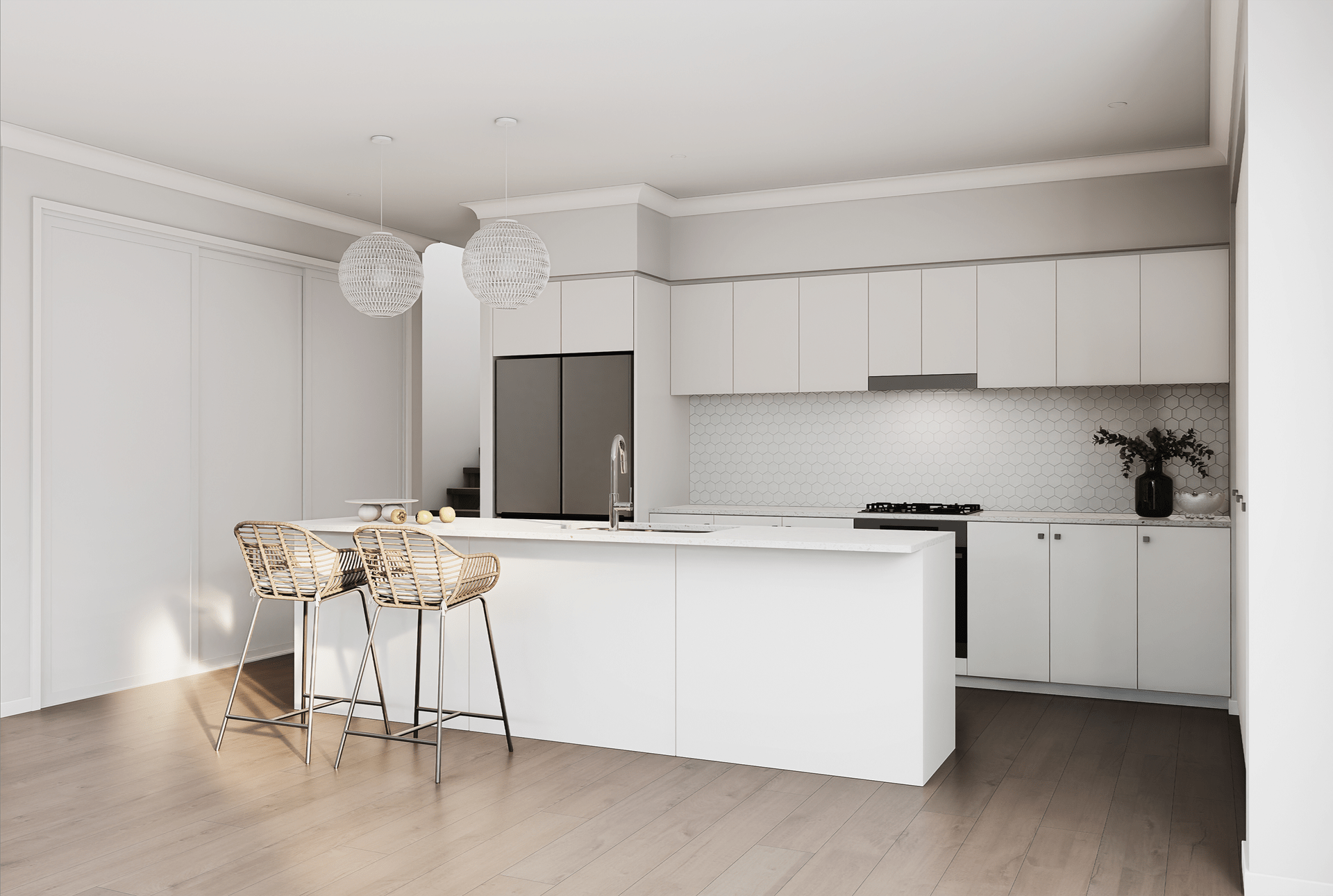

If you’re looking for an opportunity to either relocate or invest in the South East Queensland property market, get in touch with Gallery Group who have a number of diverse developments scattered across the region.

.webp)